How Credit Unions Can Stop Surviving and Start Flourishing

Dec 7

/

Peter Waitzman

The credit union industry in the United States is facing challenges. Many credit unions are realizing that they are facing increased competition from larger banks. The old selling points, such as being member-owned or working with a not-for-profit organization, no longer resonate with people experiencing modern banking.

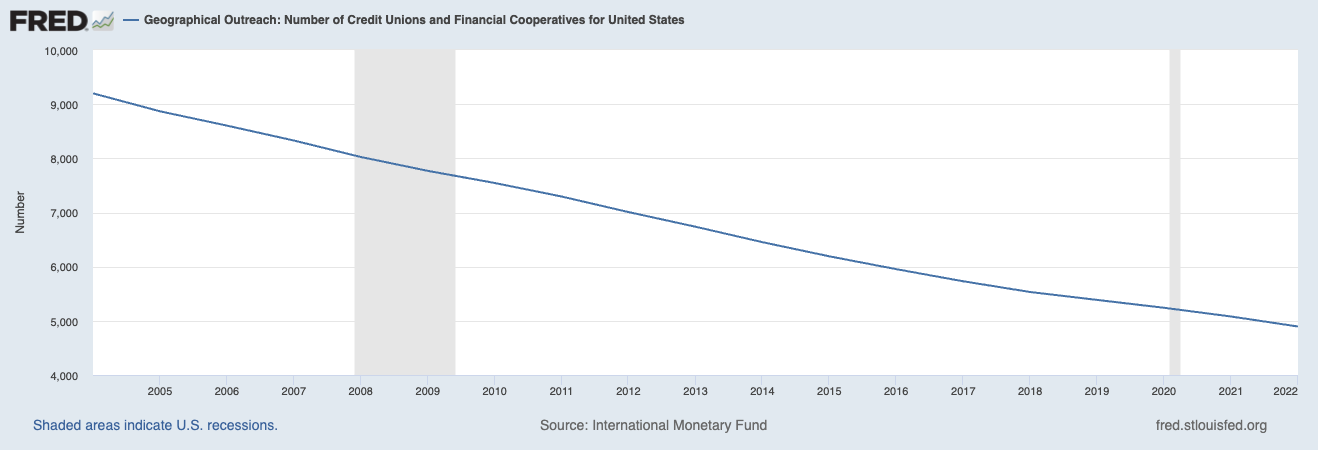

Back in the 1990s, it was common to use large banks for deposits and credit unions for borrowing. In fact, at that time, when I thought of auto loans, credit unions were the only option. Nationally, there were about 15,000 credit unions. However, the credit union landscape has changed significantly over the past 30 years, and now there are about 4,700. This trend doesn't show any signs of reversing, particularly when credit unions continue to rely on outdated talking points.

Many banks offer excellent customer experiences, competitive lending and deposit rates, as well as global access to money. The digital experience means less human interaction and more efficiency, and despite the credit union grumblings, this is what the consumer wants… including myself. On top of that, as more credit unions decide to go at it alone, it leaves the smallest ones with extremely limited resources, difficulty retaining talent, and challenges in maintaining margins.

Despite obvious signs pointing to a continued industry contraction, some credit unions are still leveraging the same strategies and messaging and hoping for a turnaround. Instead of merely surviving, it's time for credit unions to think about flourishing. To achieve this, they must offer incredible value to their members.

Of course, with current resources being stretched to the limit, how are credit unions expected to do it? The key is to get back to the core principles that led to the establishment of credit unions. They originated as a new way to offer the banking experience that put the clients' needs first. As Edward Filene said, “the objective of a Credit Union is to get ahead WITH others, rather than to get ahead of others.” Making financial wellness your fundamental organizational objective, rather than mere product ownership or borrowing, is how we start.

To achieve this, credit unions should look at implementing a financial wellness program like Expedition MoneyTM. Such programs prioritize members' financial wellbeing by providing education, coaching, and meaningful next steps. Edward Filene also said, “A credit union is an educational institution.” I feel that many credit unions have gotten away from this mandate. Start by shifting the focus away from products and towards foundational financial health. With this approach, credit unions can build trust, sell more, and naturally earn referrals.

Expedition Money, as an innovative and fun financial wellness program, can be a turnkey solution for credit unions with limited personnel and budgets. By addressing the immediate financial needs of members and providing a clear path to financial independence, credit unions can deepen their engagement and even cultivate demand for investing, planning, and wealth management.

For credit unions to thrive in the future, they need to return to their roots and prioritize the financial wellness of their members. Implementing a financial wellness program can not only improve the experience for existing members but also attract new members who seek solutions without feeling pressured. By embracing financial wellness as a core philosophy, credit unions can explore new possibilities and help their members and their business flourish.

Back in the 1990s, it was common to use large banks for deposits and credit unions for borrowing. In fact, at that time, when I thought of auto loans, credit unions were the only option. Nationally, there were about 15,000 credit unions. However, the credit union landscape has changed significantly over the past 30 years, and now there are about 4,700. This trend doesn't show any signs of reversing, particularly when credit unions continue to rely on outdated talking points.

Many banks offer excellent customer experiences, competitive lending and deposit rates, as well as global access to money. The digital experience means less human interaction and more efficiency, and despite the credit union grumblings, this is what the consumer wants… including myself. On top of that, as more credit unions decide to go at it alone, it leaves the smallest ones with extremely limited resources, difficulty retaining talent, and challenges in maintaining margins.

Despite obvious signs pointing to a continued industry contraction, some credit unions are still leveraging the same strategies and messaging and hoping for a turnaround. Instead of merely surviving, it's time for credit unions to think about flourishing. To achieve this, they must offer incredible value to their members.

Of course, with current resources being stretched to the limit, how are credit unions expected to do it? The key is to get back to the core principles that led to the establishment of credit unions. They originated as a new way to offer the banking experience that put the clients' needs first. As Edward Filene said, “the objective of a Credit Union is to get ahead WITH others, rather than to get ahead of others.” Making financial wellness your fundamental organizational objective, rather than mere product ownership or borrowing, is how we start.

To achieve this, credit unions should look at implementing a financial wellness program like Expedition MoneyTM. Such programs prioritize members' financial wellbeing by providing education, coaching, and meaningful next steps. Edward Filene also said, “A credit union is an educational institution.” I feel that many credit unions have gotten away from this mandate. Start by shifting the focus away from products and towards foundational financial health. With this approach, credit unions can build trust, sell more, and naturally earn referrals.

Expedition Money, as an innovative and fun financial wellness program, can be a turnkey solution for credit unions with limited personnel and budgets. By addressing the immediate financial needs of members and providing a clear path to financial independence, credit unions can deepen their engagement and even cultivate demand for investing, planning, and wealth management.

For credit unions to thrive in the future, they need to return to their roots and prioritize the financial wellness of their members. Implementing a financial wellness program can not only improve the experience for existing members but also attract new members who seek solutions without feeling pressured. By embracing financial wellness as a core philosophy, credit unions can explore new possibilities and help their members and their business flourish.

Peter Waitzman

CEO

Expedition Money LLC

Fully Invested

A Financial Wellness Program That Works

www.creditunionfinancialwellness.com

www.smallbusinessfinancialwellness.com

www.employeefinancialwellness.net

Company

Policy Pages

As Seen On

Copyright © 2026